Introduction

The Anti-Money Laundering and Counter-Terrorist Financing (Financial Institutions) Ordinance, Chapter 615 (AMLO) came into operation on 1 April 2012. Under the AMLO, Money service operator licence from the CCE is an offence and liable to conviction of a fine of $100,000 and imprisonment for six months. Under the AMLO, compliance with the customer due diligence and record-keeping obligations is required by money service operator (MSO).

Techtop has launched the "SmartX Exchange and Remittance System" in response to the aforementioned due diligence and record-keeping requirements, to assist money service operator in managing their business operations while also complying with relevant regulations.

Features

-

Due Diligence

Detailed customer records, regardless of the sender, recipient, individual customer, corporate customer, detailed record information, and can upload different supporting documents. And we have a built-in Dow Jones Global Watch List API, one click to complete Name Check(supports multi-language). You don't need to open another Name Check system on your computer, you can use the same system to process transactions and compliance checks, and search results are instantly output into reports and automatically saved.

-

Data Storage

All data no matter the data you input or upload attachments is stored in the cloud. We provide daily backups, so you are not afraid of data loss.

-

Ongoing Monitoring

Detailed customer records (including payees), transaction statistics, and analytical records help you monitor unusual customer transactions. You can set the certificate's validity period and quickly view the expired customers to update the information.

-

iPad and Mobile Device Support

Use the iPad APP or Android Pad to instantly take pictures of customer certification documents, and the convenience of the iPad makes it easier for you to handle business.

-

Easy to Operate

The operation interface of the system is simple and easy to use, which is easy to get started and saves time in training employees.

-

Powerful Printing

A4 printing and thermal printing are supported, and thermal printers can be rented for free. We provide basic remittance and exchange form templates, and you can modify the terms and store information on the templates yourself.

-

Statements and Reports

Detailed cash and bank accounts, and detailed order records. The data you enter is automatically turned into a quarterly customs report. Moreover, the data can be exported to Excel, so you can analyze and plug your projects.

-

Risk Scoring System

Built-in risk scoring system that scores each transaction. You can set the score of the question, the score of the reply, and the risk system to which the score belongs.

-

Continuous Updates

We provide continuous free update system due to changes in market demand and regulations.

-

Excellent Service

We provide free WhatsApp group customer service to answer questions about the system at any time.

Price

-

Monthly Subscription

You can use our products with the monthly plan. We offer free tutorial videos and a free customer service group.

Inquire

-

Customization Features

You can customize your features from our off-the-shelf SmartX and SmartX Pro bases. You can have your customize software at a lower cost and get the solution of our SmartX and SmartX Pro.

Inquire

-

Customized Software

If our current software does not meet your needs, our professional team can develop your own products. The biggest advantage of us compared with other software companies is that we are experts with the remittance system, so you don't have to explain to a technician what exchange and remittance are.

Inquire

-

Special authorization

If you have your technical team and maintain the software by yourself. Welcome to discuss with us to buy special authorization.

Inquire

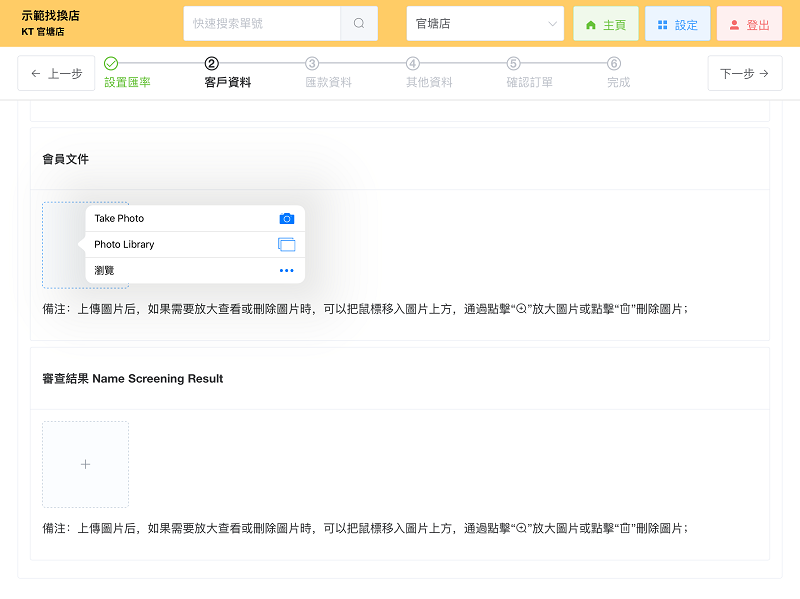

Product screenshot

-

Bank name auto completion

-

Use iPad to take Photo

-

Excellent UI

Service

-

On site Setup and traning

-

WhatsApp Group Customer Service Group

-

Free Bug Fix

-

Intergration

Request a system demo about SmartX and SmartX Pro:

REQUEST A DEMO